nh meals tax payment

This booklet contains the following New Hampshire state. If I dont collect this tax I can be forced to pay the tax penalized and put into other legal jeopardy.

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations.

. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. If you have questions call 603 230-5920. Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to-date list of.

Yes most NH taxes may be paid online. There are however several specific taxes levied on particular services or products. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

A 9 tax is also assessed on motor vehicle rentals. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Click on the link to access your existing account or to create a new account today.

Exact tax amount may vary for different items. Does Nh Have A Meals Tax. NH imposes a 9 percent tax on meals and rooms with a 3 percent vendor discount.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax. If an employee quits or resigns the wages are due by the next regular payday except if the employee gives one pay notice to quit the employer shall pay all wages due within 72 hours. It lists information on general sales taxes.

AirBnB does not allow me to collect state mandated Meals and Rooms Tax or any other kind of. Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives House Bill 1590 - License Posting for Short - Term Rental Advertisements. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates.

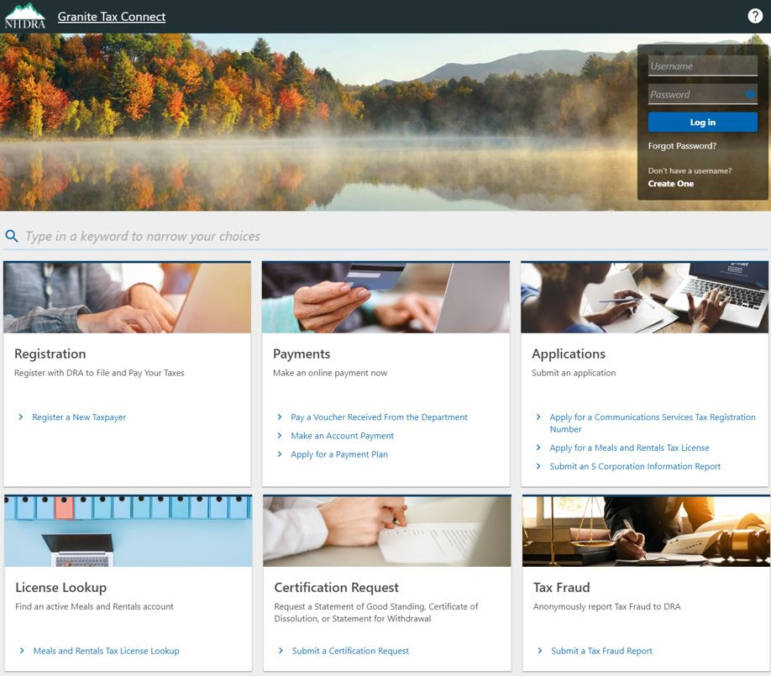

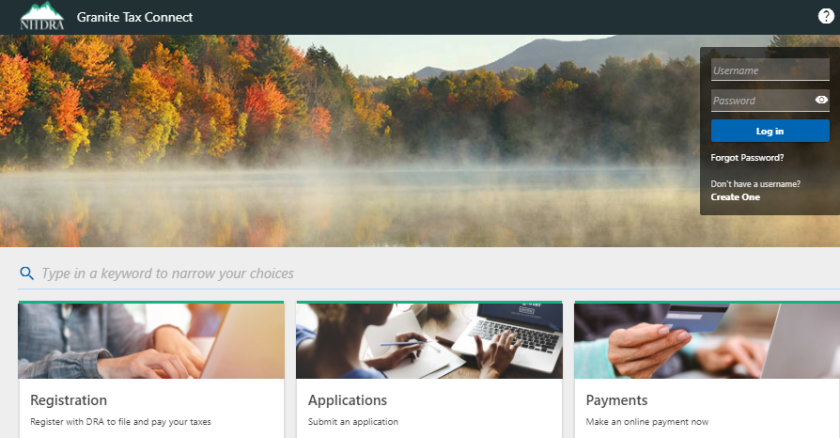

Payment for all DRA tax types should be made through the Departments online portal GRANITE TAX CONNECT. Nh meals tax payment Monday February 28 2022 Edit. B Five cents for a.

RSA 78-A - REV 700. Ad Do You Have IRS Debt Need An IRS Payment Plan. Meals And Rooms rentals Tax - Nh Department Of Revenue.

The tax and the return must be paid to and. New Hampshire is one of the few states with no statewide sales tax. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. HELOC Payoff Calculator Use this calculator to help determine the number of months necessary to repay a home equity line of credit in order to meet your financial goals.

Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check. A tax of 85 percent of the rent is imposed upon each occupancy. After that your nh meals and rooms tax form is ready.

A Four cents for a charge between 36 and 37 inclusive. A tax is imposed on taxable meals based upon the charge therefor as follows. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85 TIR 2021-004 2021 Legislative Session in Review September 7 2021.

Treasury Meals. A Four cents for a charge between 36 and 37 inclusive. If fired the wages are due within 72 hours from the time of the termination RSA 27544.

MEALS RENTALS. The NH Department of Revenue Administration has made it easier to file your Business Enterprise Taxes Business Profits Taxes Interest Dividends Taxes Meals Rentals Taxes and Real Estate Transfer Taxes online using Granite Tax Connect. Operators must file a Meals and Rentals tax return and pay over the collected tax to the Department on a monthly.

Yes most NH taxes may be paid online. 85 of the listing price including any cleaning fee and guest fee for reservations 184 nights and shorter. Accordingly New Hampshire is listed as NA with footnote 11.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. Under New Hampshire State law I am now obligated to collect the 9 Meals Rooms MR tax for the NH Revenue Administration. There are provisions for seasonal filings.

603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. Portable Document Format pdf. 2022 New Hampshire state sales tax.

Twenty-eight states allow vendor discounts most with caps of 25 to 500 per month. A 9 tax is assessed upon patrons of hotels and restaurants on meals alcohol and rooms costing 36 or more. Please mail TAX PAYMENTS ONLY to the following address.

Meals furnished by an operator to its employee for which the employee is required to pay a charge either by the cost being withheld from the employees wages or by actual payment shall be subject to tax based on the amount deducted or paid by the employee. Multiply this amount by 09 9 and enter the result on Line 2. For an up-to-date list of active Meals and Rooms Rentals Tax Operators.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. B Five cents for a charge between 38 and 50 inclusive.

Visit nhgov for a list of free pdf readers for a variety of operating systems. 2022 New Hampshire state sales tax. Hotels and restaurants that provide meals and rooms pay a 5 tax.

At Settlers Green Outlet Village Settlers Crossing And Settlers Corner You Can Save 20 To 70 At Over 60 National B Outlet Village North Conway Nh Green Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Muddy Moose Restaurant Pub North Conway North Conway Nh Pub

New Hampshire Meals And Rooms Tax Rate Cut Begins

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Nh S Most Flavorful Vegan Finds Vegan Menu Vegan Flavors

Graham Nh Where It S Good For Taxpayers Bad For Democrats

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax Money Choices

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Nh Dept Of Revenue Administration Launches New Online User Portal For Paying Taxes And More Manchester Ink Link

The Chinese Food In New Hampshire Actually Comes From A Small Town Gas Station Chinese Restaurant Chinese Food Favorite Dish

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Pin By Bellshomestead On Planning Our Homestead Food Protection Prepared Foods Things To Sell

Pin By Teri Szlosek On New Hampshire Local Eatery Restaurant Restaurant Offers

Pin By Park Inn By Radisson Gurgaon B On Park Inn Radisson Bilaspur Meals Happy Family Food

New Hampshire Revenue Dept Launches Final Phase Of Tax System